The procedure to send funds in Cameroon from an offshore Country; we will want to consider here that the funds are for investment purposes.

There are foreign investment/exchange control issues that could arise in the course of sending funds to Cameroon. It would be important to consider the applicable exchange control regulations in Cameroon. These are contained in Regulation N° 2/00/CEMAC/UMAC/CM to harmonize Exchange Control Regulations in CEMAC Member States (hereinafter “the Regulation”).

In Cameroon, the Regulation has been implemented by General Instruction N° 03/009/CF/MINFI/DCE/D on the implementation of Regulation N° 2/00/CEMAC/UMAC/CM to harmonize Exchange Control Regulations within the CEMAC Member States.

The Regulation contains two definitions of the term “direct investment.” The first definition is set out in article 86, which defines a direct investment as “the taking out of shares that a resident individual or corporate body in an economy acquires in order to gain a long-term interest in a resident enterprise of another economy.”

On its part, article 87 provides that the holding of at least 10% of the share capital of a non-resident enterprise by a resident or by a non-resident of at least 10% of the share capital of a resident enterprise shall be considered as a direct investment.

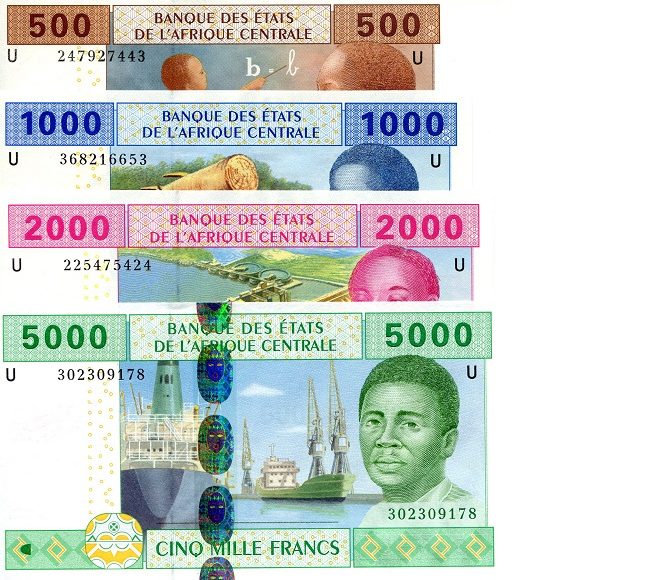

The Regulation, in its article 94, creates an obligation to declare to the finance minister any direct investment that supersedes 100 million CFA francs:

“Declarations shall be filed with the Ministry in charge of Finance in respect of direct investments by foreigners within the CEMAC zone which exceed 100 million CFA francs at least 30 days prior to the actual investment, except where such investments comprise capital increases through the ploughing back of unshared profits.”

Note that the CEMAC zone comprises six countries: Cameroon, the Central African Republic, Congo, Gabon, Equatorial Guinea and Chad.

It follows from the above that if the value of transfer and or investment supersedes 100 million CFA francs, a declaration to this effect must be made to the finance minister.

Note further that article 97 of the Regulation creates another obligation to declare:

“Actual investment or final payment in respect of direct investments, regardless of whether these are CEMAC investments abroad of foreign investments within CEMAC, shall be subject to declarations filed with the Ministry in charge of Finance and the Central Bank within 30 days of each transaction.”

With the second question as to know the procedure to remit foreign Capital from Cameroon, the same law above cited is applicable.

This law states in Article 70 that capital movements within CEMAC shall be done freely. But that approved intermediaries shall be bound to gather all useful information for statistical purposes and a posteriori control by monetary authorities.

Moreover; when it comes to capital movements between CEMAC and foreign Countries shall equally be done freely provided such movement do not violate instruments that punish financing of activities related to drugs procuring or any other trafficking that contravenes the laws in force within CEMAC. Approved intermediary shall be responsible for verifying the origin, destination or nature of said capital and for gathering information to be used by the monetary authorities for their sundry needs.

However our law firm is always available to assist any investor within the CEMAC zone in this domain.

Do not hesitate to contact us on info@bongamandyoumbilawfirm.org for more information .

Our hotline is 237 691 18 559/

Document link : https://mega.nz/file/aAgxjAjJ#V96LcuTU8MRP8-0czGX8ET7VrpjNHyiz4SRsu95hUwU